Building Zenda

To help founders bring cutting-edge technology to underserved industries.

Our Founding Story

We launched Zenda to put our own money behind bold entrepreneurs who aspire to redefine overlooked industries. We believe that most of the world’s businesses are missing the full benefits of modern software infrastructure and industry-specific solutions.

Esteban, our founder and general partner, is a descendant of coal miners who became successful entrepreneurs by modernizing the oil and gas industry in Colombia. He started, scaled, and exited companies in various industries, including fintech, software, commerce, and education. Chetan and Evan are part of the foundational team that scaled Twilio through its IPO. Our origins and entrepreneurial journey has inspired us to partner with courageous entrepreneurs who want to revolutionize overlooked industries in the U.S. and LATAM.

Last week, we announced our inaugural $26M fund. We will invest between $500k and $1.5M in pre-seed and seed stage companies initially and provide additional capital to our top-performing companies.

In the coming decade, we predict a surge of vertical software and enabling technology platforms which will drive large-scale productivity improvements, especially across non-tech industries. We seek to partner with founders with the technical expertise to harness generational technologies like cloud computing and machine learning while possessing the industry know-how to recognize the most significant and solvable opportunities for a sizable customer base.

Our Team & How We Operate

Our process requires close collaboration with a network of founders, operators, potential customers, investors, and researchers to build domain knowledge within a subset of industries we wish to explore in-depth. For example, we invested in Solvento, a payments and lending infrastructure company for SME truckers, after developing a thesis around B2B payments and lending infrastructure in LATAM. Since then, Solvento has experienced significant growth and its CEO, Jaime, became a venture partner at Zenda, showcasing our commitment to build strong relationships with the founders we support.

We aim to replicate this approach across other underserved industries enabling us to get an early look at unique investment opportunities, make high-quality investment decisions, and support portfolio companies.

Zenda goes beyond the cap table. We work closely with founders and lead investors, providing industry expertise, operational assistance, and networking opportunities to support portfolio companies from day one to IPO.

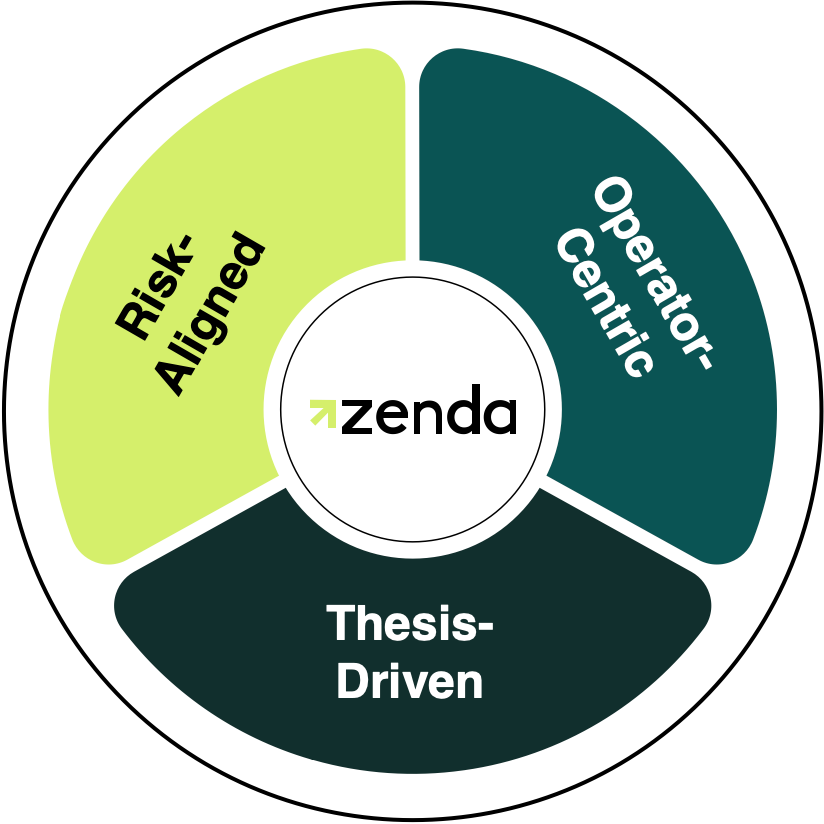

Our investment approach stems from three guiding principles.

Provide founders with operational support through professional networks in each of our focus areas.

Develop a thesis-driven point-of-view, complemented by extensive research.

Be the most risk-aligned institutional investor on the cap table, which is why we put our money on the line.

If our mission aligns with yours, subscribe below and stay tuned! 🚀